Investment Case for GenAI Apps x Financial and Professional Services

TLDR:

These days, I am most fascinated by the potential of GenAI apps to transform the financial and professional services industries. Having lived and breathed this space, I have worn various hats as an investment banker, equity investor, management consultant, and corporate finance professional. In addition, I have experienced past technology waves as a tech operator and founder. Combining these two sides of experience, I believe we are at a pivotal moment for the next big technology (GenAI) to augment or disrupt an industry worth tens of trillions of dollars.

While significant value has already been created on the hardware and model side of GenAI, I believe the application side is just beginning to take off. Over the next decade, I foresee significant value being created by the next wave of GenAI x financial and professional services startups.

The TAM for GenAI applications is more than 10x that of SaaS. Enterprise adoption is happening much faster than expected, driven by FOMO across the industry. Large enterprises are eager to work with even the earliest-stage startups, and real use cases with strong value propositions are emerging. CEOs and COOs, not just CTOs, are showing strong interest and attention. Companies are setting aside specific AI budgets, and enterprises are even pitching startups on the value that GenAI can bring to them—not only efficiency savings but also longer-term alpha-generating opportunities.

I believe now is a special time to invest in GenAI x services startups, and we will see tremendous value creation over the next 10-15 years. Early-stage startup valuations remain highly attractive, and it’s not hard to envision a future that some startups will be acquired by large financial services enterprises or grow into large standalone companies, similar to how the SaaS technology wave created over $1 trillion in market cap just among application companies.

If you are a startup building in this space or if you are interested in partnering together, please reach out.

Market Opportunity: 10x That of SaaS

Cloud computing was the last technology wave to transform the B2B landscape, predominantly impacting software by replacing on-prem solutions with cloud. The exciting potential of GenAI is its ability to replace services with software, offering a TAM that is over 10x the size of the software market today.

The entire software market, including both SaaS and on-prem, generates ~$650B in revenue today. In comparison, the total professional services sector is ~$6.5 trillion. Examples include legal services (~$800B), accounting services (~$700B), consulting services (~$400B), investment banking services (~$150B), investment advisory services (~$100B). Note this does not include core service functions within companies that could be replaced or augmented by genAI, such as customer support, administrative services, and sales services, nor does it include healthcare services. When considering all these factors, the potential TAM for GenAI applications could easily reach tens of trillions of dollars.

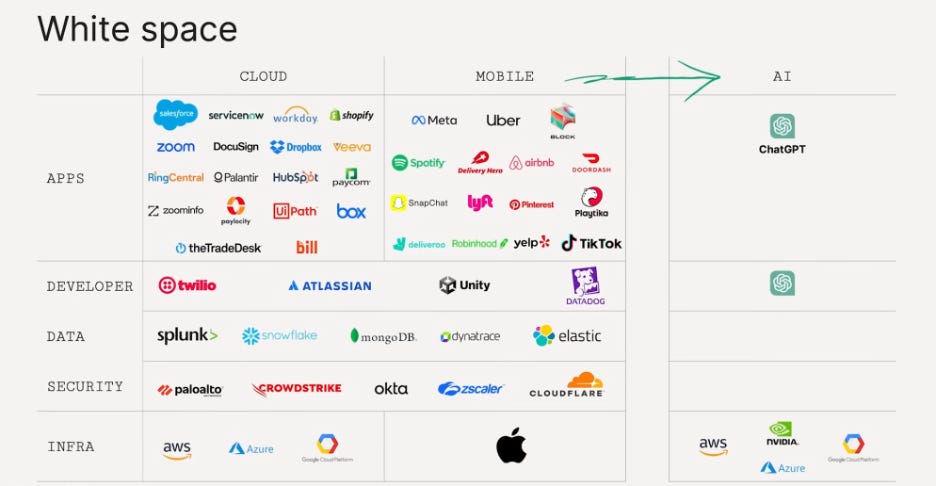

While significant value has already been created on the hardware and infrastructure side of the AI wave, as evidenced by companies like Nvidia, OpenAI, and big tech cloud providers, the application side is still in its early stages with substantial white space for future value creation.

Currently, the combined market cap of SaaS-native application companies, such as Salesforce and Workday, stands at ~$1,100B. In comparison, the B2B application side of GenAI remains wide open for new players. Despite some recent funding rounds like Harvey ($1.5B) and Hebbia ($0.7B), there is still potential for creating $1 trillion+ in market value in the GenAI-native application space.

Enterprise Adoption: Much Faster Than Expected

While GenAI is an exciting technology, its ability to create significant market value hinges on strong market adoption, particularly among enterprise customers.

"The rate of adoption in enterprises is going to be way faster than people realize. I think we will buck convention on that - enterprises have a reputation of being slow adopters of technology - that will not be true here."

- Brad Lightcap, the COO of OpenAI, on a recent podcast

Below are some observations on the current state of enterprise adoption of GenAI among financial and professional services firms.

1. Fear of Missing Out (FOMO)

Financial services firms are driven by a fear of missing out, pushing them to adopt the latest AI tools to stay competitive.

“There’s a lot of FOMO in the market. Financial services firms are looking for the next AI tool to set them apart from competitors.” - one genAI founder

“Everyone realizes this is the future of the industry. Many COOs or Chief Innovation Officers have a mandate to figure out this AI thing and not to be left behind.” - another genAI founder

2. Willingness to Work with Early-Stage Startups

Even the earliest-stage startups, consisting only of co-founders with no employees and no institutional funding, have been successful in securing meetings directly with C-level leadership of large financial services enterprises, some of which have turned into paid pilots.

In some cases, financial services firms are even pitching startups on the value that GenAI can bring to them, focusing on both near-term efficiency savings and longer-term revenue and alpha-generating opportunities.

3. Strong Customer Pull

The demand from enterprise financial services firms is strong, contrasting with the typical outbound sales efforts seen in SaaS, indicating a higher level of market readiness to adopt GenAI technology. One founder noted, “We’ve got so much inbound customer interest that we don’t expect to do much outbound for the next 12-18 months.”

4. Dedicated GenAI Budgets

Enterprises are setting aside specific GenAI budgets to experiment with and try out AI tools, separate from core technology budgets such as SaaS spending.

5. Emerging Use Cases with Clear Value Proposition

Use cases with strong value propositions are starting to emerge, especially in areas typically viewed as grunt work. One pushback in GenAI applications has been the gap between reality and high expectations from demos. However, we are beginning to see use cases where GenAI technology works, often built by founders who have experienced the problems firsthand as former financial services employees. In some areas of repetitive or manual grunt work, GenAI tools can reduce completion time by more than 80%.

6. CEO Strategic Priorities

Unlike prior technology waves that often fell under the job of CTOs, GenAI has consistently been viewed as a top strategic priority by CEOs of the largest financial services firms.

JP Morgan CEO Jamie Dimon said, "While we do not know the full effect or the precise rate at which AI will change our business — or how it will affect society at large — we are completely convinced the consequences will be extraordinary and possibly as transformational as some of the major technological inventions of the past several hundred years: Think the printing press, the steam engine, electricity, computing, and the Internet, among others."

Goldman Sachs CEO David Solomon emphasized the company's focus on AI, stating, "We're talking about a level of scale that is candidly unprecedented. We're very, very focused on it and very engaged."

Thomson Reuters CEO Steve Hasker announced “dry powder of around $8 billion” to spend on acquisitions and investments in AI and looks to invest at least $100 million annually to develop its own AI technology.

An End Note

In conclusion, the potential of GenAI to revolutionize the financial and professional services industries is immense. With a TAM that is 10x that of SaaS, rapid enterprise adoption, and a willingness from Fortune 500 firms to partner directly with early-stage startups, I expect significant value creation in the coming decade.

If you are a startup building in the space, please reach out - I’d be happy to share more thoughts and support you on this journey. If you are interested in partnering together, please drop me a note!

A special thank you to the founders who have shared their perspectives and observations that have contributed to this blog post.